36+ mortgage disclosure improvement act

Check Your Loan Eligibility With Multiple Secured Loan Lenders In Minutes. Borrow Long Term Over 1 - 30 Years.

Pdf Wellbeing Through Self Fulfilment Examining Developmental Aspects Of Self Actualization Itai Ivtzan And Hannah Thompson Academia Edu

Ad See Real Rates Get Personalised Quotes Compare Your Home Improvement Loan Options.

. Any extension of credit secured by the dwelling of a consumer. Web The Federal Reserve Board recently approved final rules that revise the disclosure requirements for mortgage loans under Regulation Z Truth in Lending to implement the Mortgage Disclosure Improvement Act MDIA enacted in July 2008. Any extension of credit secured by the dwelling of a consumer.

A Truth in Lending Act Disclosures. The seven business-day delay from. Web Mortgage Disclosure Improvement Act now applies to.

Refinance loan transactions and home equity loans. Web Mortgage Disclosure Improvement Act of 2007 - Amends the Truth in Lending Act to require a creditor to disclose to a consumer with respect to an extension of credit secured by the consumers dwelling that the consumer is not required to complete. Loans For Most Applicant Types Arranged Quickly.

On October 3 2008 the Congress amended the MDIA in connection with its enactment of the Emergency Economic Stabilization Act of 2008 Stabilization Act. Web Beneficiary Lender Trustor Borrower Trustee Third PartyDeed in Lieu of ForeclosureA deed given by the mortgagor to the mortgagee when the mortgagor is in default under the terms of the mortgage. Ad Need A Loan For Home Improvements.

It does not apply to Home Equity Lines of Credit. Ad Need A Loan For Home Improvements. Web Truth in Lending Act - Consumer Financial Protection Bureau.

Non Owner Occupied aka. Web This title may be cited as the Mortgage Disclosure Improvement Act of 2008. Check Your Loan Eligibility With Multiple Secured Loan Lenders In Minutes.

Low Rates Market Comparison. Web 2021 Reportable HMDA Data. Web Mortgage Disclosure Improvement Act now applies to.

In October 2008 Congress. ENHANCED MORTGAGE LOAN DISCLOSURES. Web The Home Mortgage Disclosure Act HMDA is a federal law that requires lenders to keep certain information about their mortgage applicants.

It does not apply to Home Equity Lines of Credit. Refinance loan transactions and home equity loans. This means that a creditor must deliver or mail the early disclosures for all mortgage loans subject to RESPA no later than 3 business days general definition.

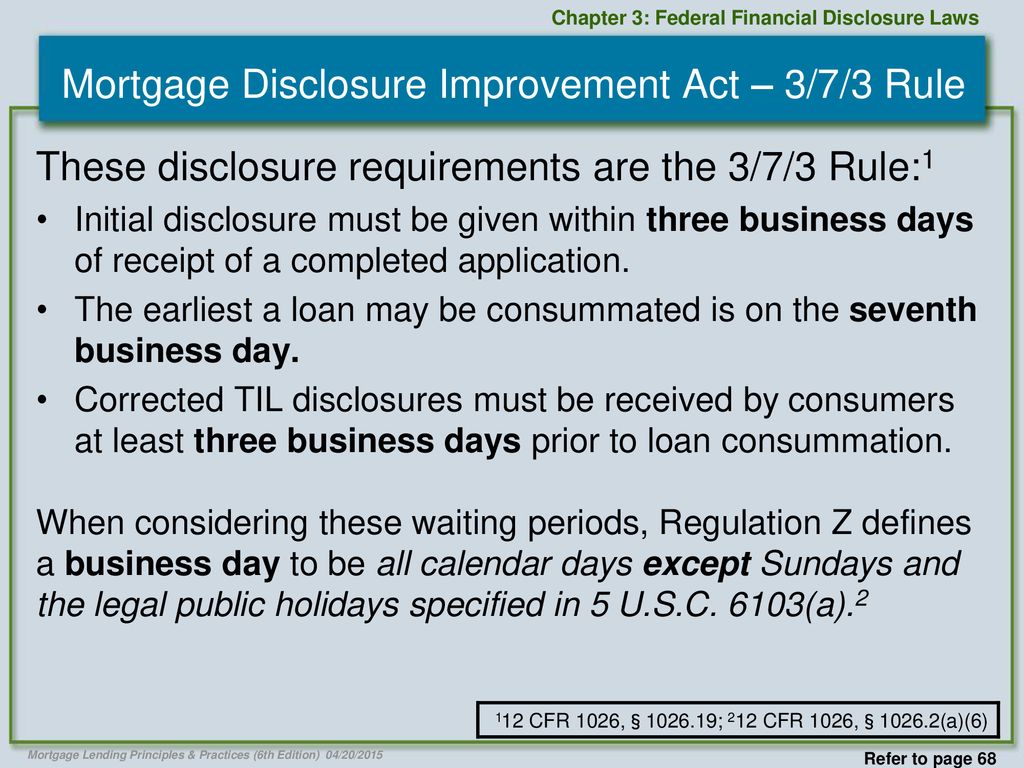

Known as the 373 Rule these. Non Owner Occupied aka investment. This is a way for the mortgagor to avoid foreclosure.

These data help show whether lenders are serving the housing needs of their communities. Web The Home Mortgage Disclosure Act HMDA requires many financial institutions to maintain report and publicly disclose loan-level information about mortgages. Borrow Long Term Over 1 - 30 Years.

Web Oct 1 2018 248 Dislike Share Save Affinity Real Estate Mortgage Training 418K subscribers For more study aids to pass the NMLS Mortgage Loan Originator MLO Exam please checkout out our. Web TILA known as the Mortgage Disclosure Improvement Act of 2008 MDIA. Low Rates Market Comparison.

A regulatory and reporting overview reference chart Reference tool for HMDA data required to be collected and recorded in 2021 and reported in 2022 as well as when and how to report HMDA data as not applicable. Web Back in 2009 the Mortgage Disclosure Improvement Act MDIA brought us the following changes to slow down the loan process and to make sure a borrower has the latest and greatest information in hand before loan closing. Loans For Most Applicant Types Arranged Quickly.

Web The Home Mortgage Disclosure Act HMDA is a federal law approved in 1975 that requires mortgage lenders to keep records of key pieces of information regarding their lending practices which. Section 128 b 2 of the Truth in Lending Act 15 USC. Web Recent congressional amendments to Truth in Lending Act TILA known as the Mortgage Disclosure Improvement Act of 2008 MDIA have been included in a final rule amending Federal Reserve Regulation Z.

Web Disclosure of good faith estimate of costs must be made no later than. 3 days after application. Web Congress enacted the Housing and Economic Recovery Act of 2008 in July of 2008 which included amendments to Regulation Z Truth in Lending known as the Mortgage Disclosure Improvement Act of 2008 MDIA.

Ad See Real Rates Get Personalised Quotes Compare Your Home Improvement Loan Options. This information includes race age sex and ethnicity among other data points about borrowers and.

Market Update Mortgage Disclosure Improvement Act Mdia Ppt Download

Bc3 Academic Catalog 2022 2023 By Butler County Community College Issuu

Free 36 Request Forms In Ms Word

Bank Of Queensland Smart Saver Account Review Finder

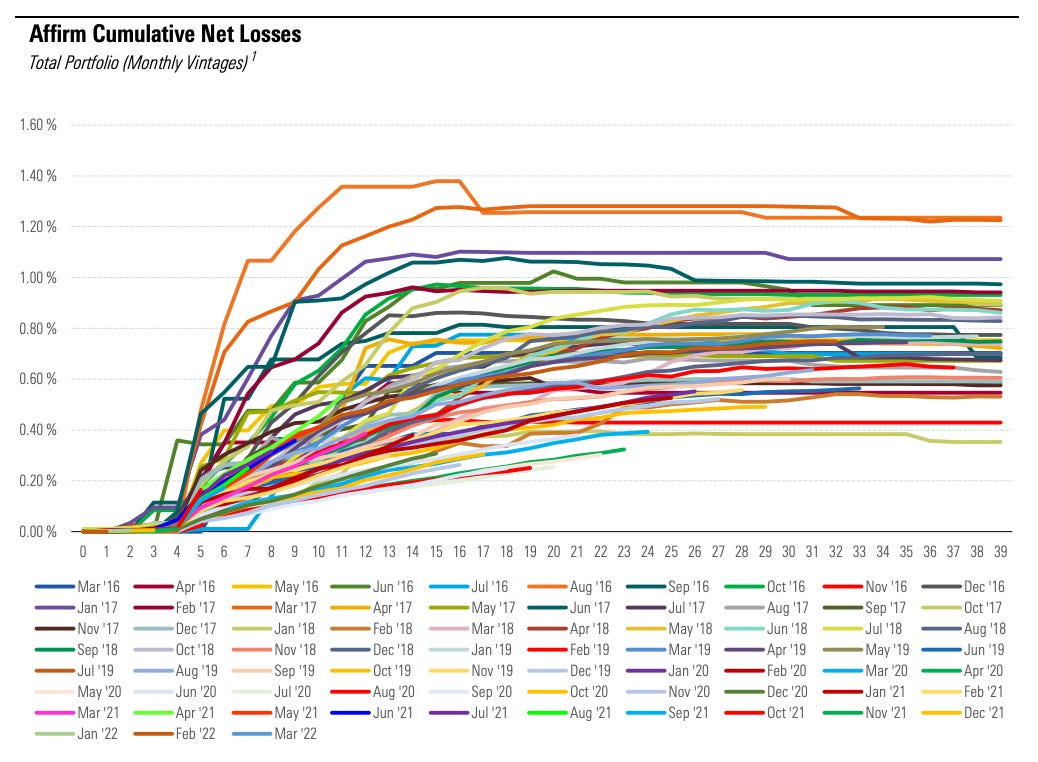

How Bnpl Really Works By Jeremy Solomon

Cfpb Provides Analysis On How To Complete Closing Disclosure Alta Blog

Sec Filing Mercury Systems Inc

Completing Trid Old School Can Disclosures Be Completed By Hand Alta Blog

Market Update Mortgage Disclosure Improvement Act Mdia Ppt Download

By Order Of The Commander Air Force Recruiting Air Force Link

Federal Register Home Mortgage Disclosure Regulation C

Trid Guidelines What Is Mdia Banker S Compliance Consulting

Federal Financial Disclosure Laws Ppt Download

How Much House Can You Afford The 28 36 Rule Will Help You Decide

Pdf The Perennial Question So Where Will That Take You An Exploratory Study Of University Of Waikato Students Judgements Of The Value Of Study In The Arts Elna Fourie Academia Edu

Market Update Mortgage Disclosure Improvement Act Mdia Ppt Download

The Harmonisation Of European Contract Law Implications For European Private Laws Business And Legal Practice Studies Of The Oxford Institute Of Eu Pdf Private Law Civil Law Legal System